Chart( REPORT ON JAPANESE TAXATION BY THE SHOUP MISSION Chap 4 Sec C )

[prev]

[# The next table is copied by the web editor as a model of the upper chart's comments.]

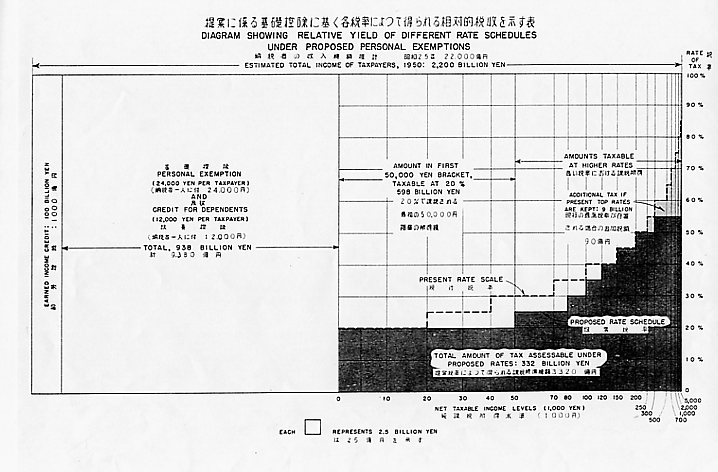

DIAGRAM SHOWING RELATIVE YIELD OF DIFFERENT RATE SCEHDULES

UNDER PROPOSED PERSONAL EXEMPTIONS

|

<------------- ESTIMATED TOTAL INCOME OF TAXPAYERS, 1950: 2,200 BILLION YEN ---------> |

| EARNED INCOME CREDIT :100 BILION YEN |

PERSONAL EXEMPTION (24,000 YEN PER TAXPAYER) AND CREDIT FPR DEPENDRNTS (12,000 YEN PER TAXPAYER) <---- TOTAL, 938 BILLION YEN -----> |

<------------------> |

<---------------> |

| 0 | 5000 |

|

NET TAXABLE INCOME LEVELS(1,000 YEN) | |||

|

EACH | ||||

|

----- line: RESENT RATE SCALE Line of (white and greay) area and black area: PROPOSED RATE SCHEDULE |

Black area's comment: |

gray area's comment: ADDITIONAL TAX IF PRESENT TOP RATES ARE KEPT: 9 BILLION |

fileid:#221 / Issued:2002-02-15 / Last-modified:2004-10-01